Unveiling The Commonwealth Virginia Department Of Taxation: A Comprehensive Guide For Every Taxpayer

Welcome to the world of Virginia taxation, where understanding the system can save you both time and money. The Commonwealth Virginia Department of Taxation plays a pivotal role in shaping how residents interact with state-level fiscal responsibilities. Whether you're filing your first tax return or navigating complex deductions, this department is your go-to resource. So, buckle up and let's dive into the nitty-gritty details of Virginia's tax landscape.

Now, you might be thinking, "Why should I care about the Department of Taxation?" Well, here's the deal: taxes affect everyone, from individuals to businesses. The decisions made by this department directly impact your wallet, so it pays to be informed. Understanding how the system works can help you avoid penalties, take advantage of credits, and even save a buck or two.

In this article, we’ll break down everything you need to know about the Commonwealth Virginia Department of Taxation. From its history to current policies, we’ve got you covered. Let’s make sure you’re not left scratching your head when tax season rolls around. Ready? Let’s get started!

Read also:Jesse Spencer The Rising Star Who Stole Hearts In Hollywood

Here's a quick roadmap to guide you through this comprehensive guide:

- Overview of the Commonwealth Virginia Department of Taxation

- A Brief History of the Department

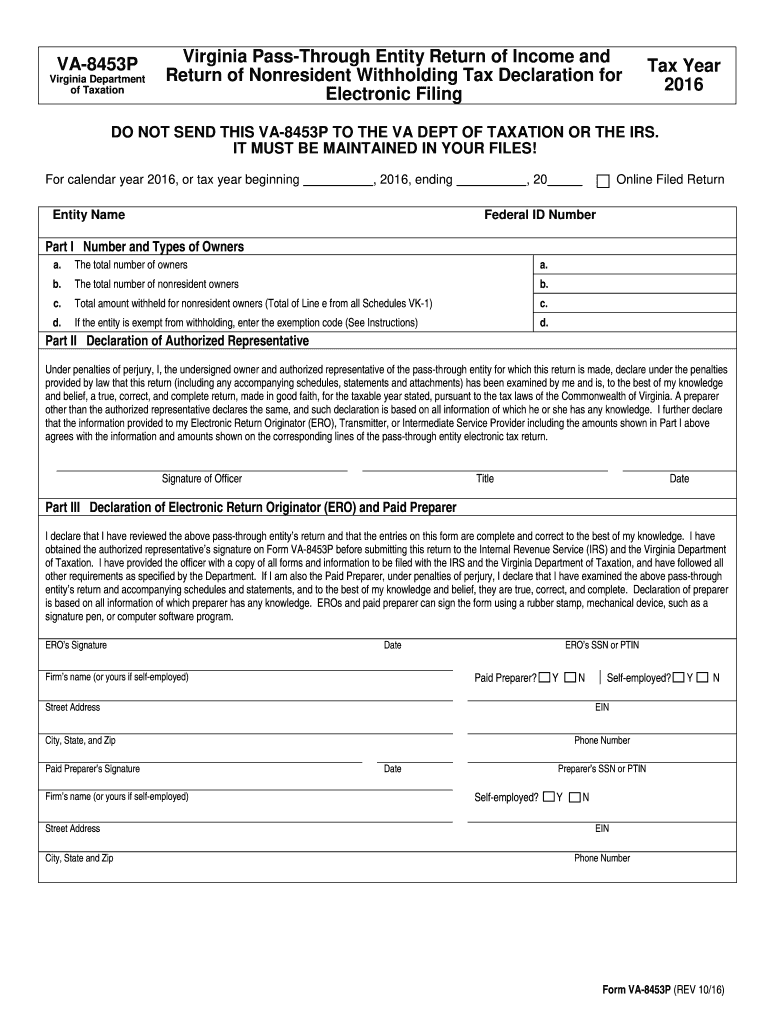

- Services Offered by the Department

- Filing Your Taxes in Virginia

- Tax Credits and Deductions

- Understanding Tax Penalties

- Tax Obligations for Businesses

- Useful Resources for Taxpayers

- Future Plans and Initiatives

- Wrapping It Up

Overview of the Commonwealth Virginia Department of Taxation

The Commonwealth Virginia Department of Taxation is the state agency responsible for administering and enforcing Virginia’s tax laws. Think of it as the backbone of Virginia's fiscal system. This department oversees a wide range of tax-related activities, from personal income tax to sales tax, ensuring that everyone pays their fair share.

One of the key responsibilities of the department is to provide guidance and support to taxpayers. They offer resources, answer questions, and help individuals and businesses navigate the often-confusing world of taxes. Whether you're dealing with a simple return or a complex audit, the department is there to assist you every step of the way.

But wait, there's more! The department also plays a crucial role in shaping tax policy. By analyzing economic trends and gathering feedback from stakeholders, they ensure that Virginia's tax laws remain fair and effective. This ongoing process helps maintain a balanced and sustainable fiscal environment for all Virginians.

Key Functions of the Department

- Administering state tax laws

- Providing taxpayer assistance and education

- Enforcing compliance through audits and penalties

- Developing and implementing tax policies

A Brief History of the Department

The Commonwealth Virginia Department of Taxation has a rich history that dates back to the early days of the state. Established in response to the growing need for a structured tax system, the department has evolved significantly over the years. Back in the day, tax collection was a manual process, but now, thanks to technology, it's all about digital efficiency.

In the 19th century, Virginia's tax system was relatively simple, focusing primarily on property taxes. However, as the state's economy grew, so did the complexity of its tax laws. The department had to adapt quickly to meet the demands of a changing society. Today, they handle everything from income tax to corporate taxes, making sure no stone is left unturned.

Read also:Ti Story The Ultimate Guide To Understanding The Rise And Evolution

Throughout its history, the department has faced numerous challenges, from economic downturns to legislative changes. Yet, they've always managed to stay ahead of the curve, ensuring that Virginia's tax system remains robust and resilient.

Services Offered by the Department

When it comes to services, the Commonwealth Virginia Department of Taxation has got you covered. From online resources to in-person assistance, they offer a variety of options to meet the diverse needs of taxpayers. Here's a closer look at what they have to offer:

Online Services

In today's digital age, convenience is key. That's why the department provides a range of online services, allowing you to handle your tax matters from the comfort of your home. You can file your taxes electronically, check the status of your refund, and even update your account information. It's like having a personal tax assistant at your fingertips.

In-Person Assistance

For those who prefer face-to-face interaction, the department offers in-person assistance at various locations across the state. Whether you need help with a specific issue or just want to clarify some doubts, their knowledgeable staff is there to guide you. No need to worry about long wait times or complicated procedures.

Filing Your Taxes in Virginia

Filing your taxes doesn't have to be a daunting task. With the right tools and guidance, you can breeze through the process in no time. The Commonwealth Virginia Department of Taxation provides all the resources you need to file your taxes accurately and efficiently.

First things first, make sure you gather all the necessary documents. This includes your W-2 forms, 1099s, and any other relevant paperwork. Once you have everything in order, you can choose to file electronically or by mail. Electronic filing is fast, secure, and often comes with a quicker refund turnaround.

And here's a pro tip: always double-check your calculations before submitting your return. A small mistake can lead to delays or even penalties. If you're unsure about anything, don't hesitate to reach out to the department for assistance.

Common Mistakes to Avoid

- Forgetting to include all sources of income

- Incorrectly calculating deductions

- Missing deadlines

Tax Credits and Deductions

Who doesn't love saving money? The Commonwealth Virginia Department of Taxation offers a variety of tax credits and deductions to help you keep more of your hard-earned cash. From education expenses to energy-efficient home improvements, there's something for everyone.

One of the most popular credits is the Earned Income Tax Credit (EITC), which benefits low- to moderate-income individuals and families. Another great option is the Child and Dependent Care Credit, which helps offset the cost of childcare. By taking advantage of these credits, you can significantly reduce your tax liability.

Don't forget about deductions! Whether it's mortgage interest, charitable contributions, or medical expenses, every little bit counts. Make sure to keep detailed records throughout the year to maximize your deductions come tax time.

Understanding Tax Penalties

No one likes penalties, but they're a necessary part of the tax system. The Commonwealth Virginia Department of Taxation enforces penalties to ensure compliance and fairness. However, understanding why these penalties exist and how to avoid them can save you a lot of headaches.

Common penalties include late filing, late payment, and underpayment of estimated taxes. The good news is that most of these can be avoided by staying organized and meeting deadlines. If you find yourself in a bind, the department offers payment plans and penalty relief options to help you get back on track.

Remember, ignorance of the law is not an excuse. It's essential to familiarize yourself with the rules and regulations to avoid unnecessary penalties. And if you're ever unsure, don't hesitate to seek professional advice.

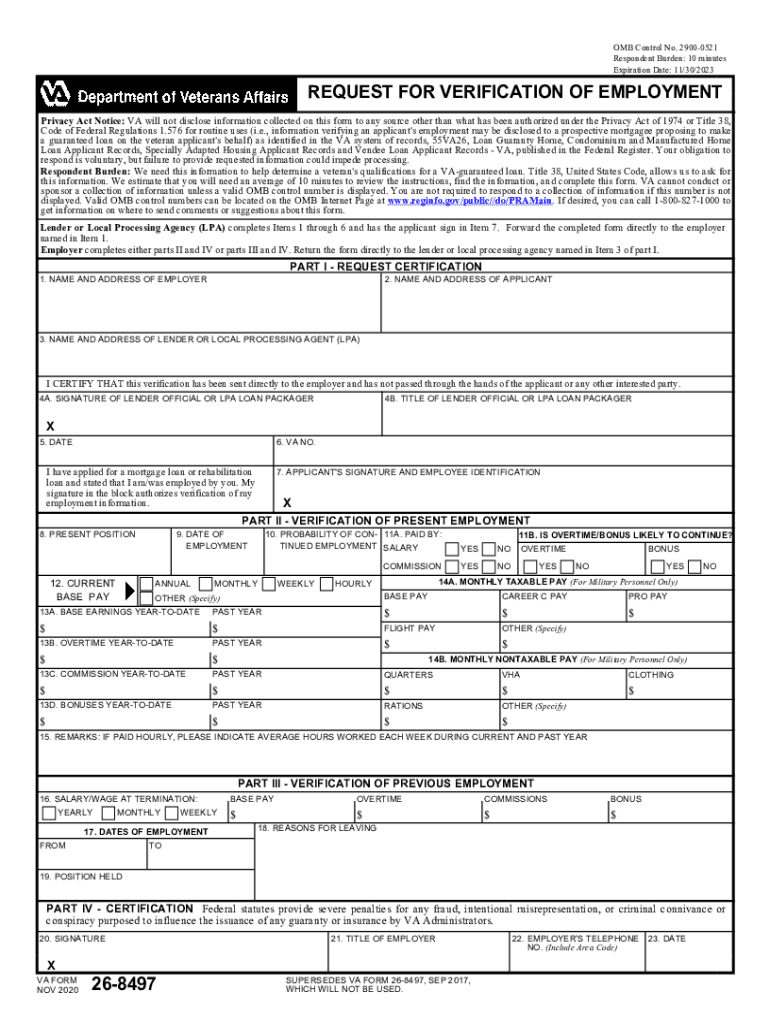

Tax Obligations for Businesses

Businesses, big or small, have their own set of tax obligations to fulfill. The Commonwealth Virginia Department of Taxation provides specific guidance and resources to help businesses navigate the complexities of state taxes. From sales tax to corporate income tax, they've got all the bases covered.

One of the key responsibilities for businesses is collecting and remitting sales tax. This involves registering with the department, tracking sales, and submitting quarterly or monthly reports. Failure to comply can result in penalties and interest charges, so it's crucial to stay on top of things.

Additionally, businesses must file corporate income tax returns and pay the appropriate amount based on their profits. The department offers various resources, including workshops and webinars, to help businesses understand their obligations and stay compliant.

Key Business Tax Obligations

- Sales tax collection and remittance

- Corporate income tax filing

- Employer tax responsibilities

Useful Resources for Taxpayers

The Commonwealth Virginia Department of Taxation understands that knowledge is power. That's why they provide a wealth of resources to help taxpayers make informed decisions. From publications and FAQs to online tools and calculators, they've got everything you need to succeed.

One of the most valuable resources is the department's website, which is packed with information on tax laws, forms, and procedures. You can also find contact information for local offices and links to external resources. Whether you're a first-time filer or a seasoned pro, there's always something new to learn.

And let's not forget about the department's social media channels. They regularly post updates, tips, and reminders to keep you in the loop. Following them can help you stay ahead of the curve and avoid any unpleasant surprises.

Future Plans and Initiatives

Looking ahead, the Commonwealth Virginia Department of Taxation has some exciting plans in the works. They're committed to modernizing their systems and improving the overall taxpayer experience. From enhanced online services to streamlined processes, the future looks bright.

One of their top priorities is increasing accessibility for all taxpayers. This includes expanding multilingual resources and providing more in-person assistance at remote locations. By breaking down barriers, they aim to make tax compliance easier and more equitable for everyone.

Additionally, the department is exploring new technologies to enhance data security and accuracy. With cyber threats on the rise, protecting taxpayer information is more important than ever. Their commitment to innovation ensures that Virginia's tax system remains at the forefront of fiscal management.

Wrapping It Up

There you have it, a comprehensive guide to the Commonwealth Virginia Department of Taxation. From its history and services to future plans and initiatives, we've covered all the essentials. Understanding this department and its role in your life can make a world of difference when it comes to managing your taxes.

Remember, knowledge is your best ally when dealing with taxes. Stay informed, stay organized, and don't hesitate to reach out for help when needed. Whether you're a resident or a business owner, the department is there to support you every step of the way.

So, what are you waiting for? Take action today by exploring the resources available and making the most of your tax opportunities. And if you found this article helpful, don't forget to share it with your friends and family. Together, let's make tax season a little less stressful!